In the 2012 Global Finance Who’s Who in Treasury & Cash Management Survey, it is stated that more than 60% of the organizations formally assess or monitor their cash flows daily to meet operating requirements. While you do not need to do it daily it is wise to do it once a month for the next three months to be on top of your personal finance. A cash flow forecast, as its name implies, is to estimate your future cash flow situation. The whole purpose is to manage early in case of a shortfall in the near future.

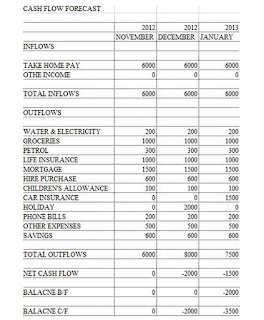

Here is a simple cash flow forecast statement. For simplicity, it is assumed that you are not using credit cards. You are now at the end of October 2012 and you have prepared for a three-month forecast for the next three months:

|

| Cash Flow Forecast |

November 2012

Cash Inflows

Where are your sources of income in the form of cash? It can be your salary, income from part-time work, and dividends from stocks and shares. In this example, your take-home pay is your only cash inflow which is $6000.

Cash Outflows

It is a good budget because there is no overspending and there is also an amount of $600 set aside for savings. Other expenses vary from month to month and they include such items as eating out, gifts, clothing, minor car repairs, and donations.

Net Cash Flow

In the month of November income equals Expenses, so it is zero balance.

Balance B/F

It is assumed that in the current month, your actual income ties with total cash outlay so there is no surplus fund to bring forward to November 2012, so the balance brought forward is zero.

Balance C/F

There is no money to bring forward to the month of December.

December 2012

There is a special item in December. You are going for a Christmas holiday and you have budgeted for an amount of $2000. Your cash flow forecast clearly shows that you are short of exactly 2000 in the month of December. You will have to decide now if you are going ahead with your holiday you will need additional funding.

January 2013

There is another shortfall of $1500 in January 2013 because your car insurance is due in January. If you have set aside $125 per month every month you would have ready cash of $1500 by January 2012. Since it is not done, you will have to look for additional cash of $1500.

Now

The forecast tells you that you need an additional fund of $3500 to meet expected expenses in the next three months. For those who have included savings as an expense item in their monthly budget, there is no problem; all you need to do is to draw from your savings. Without saving you can either draw from your emergency fund or liquidate part of your investment. When you do not have other sources of ready cash you will need to borrow or apply for a personal loan now and get into debt. You do what you need to do now and avoid getting into a panic situation later.

This is how my wife and I manage our expenses. The problem with most budgeting tools out there is that they don't allow you do this. They simply help you "budget", but budgeting alone isn't really that helpful.

ReplyDeleteIf you go over your budget on a particular month, you won't know how that will affect your plan months later because you have no forecasting feature.

We use Kualto which allows us to navigate forward and see how our spending today will affect our account balance in the future.

Kualto is an effective tool to do budget and cash flow forecasting

ReplyDelete